24+ Revolving line of credit

Credit limit access is easily available 247 online over the phone in person or by using HELOC checks no minimum amount Simple interest variable rate. 499 Prime Rate is 550 as of September 12 2022.

Credit Repair Tips Excellent Credit Score Want To Boost Your Credit Score Excellent Credit Score Credit Repair Credit Score Debt Payoff

The Credit Line Hybrid is designed to help clients get funding based strictly on personal credit quality.

. Auto rental collision damage. Pay monthly with no interest and get additional credit line boosts for your tradeline to build your business credit faster. The following example is for illustration purposes only.

Variable Interest rate is based on the published Prime Rate and may change monthly. The revolving credit lines which typically let users borrow 3000 to 100000 were pitched as a way to consolidate higher-interest credit card debt pay for home renovations or avoid overdraft. Credit cards tend to have higher interest rates and charge additional fees for cash advance and balance transfers.

855 596-3655 Agents available 24 hours a day 7 days a week. For your security Kabbage uses data encryption and read-only access to better. We will help.

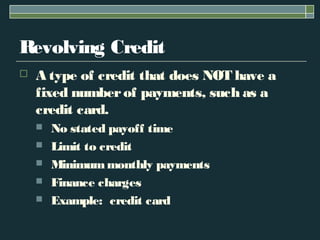

In 1882 Goldmans son-in-law Samuel Sachs joined the firm. Revolving credit is a type of credit that does not have a fixed number of payments in contrast to installment credit. Get pre-qualified in as little as 24 hours.

Once you pay down part of the balance you can draw more cash. 524 150000 - 750000. Seat with Pocket Spring Webbing.

After 8 years the fsagovuk redirects will be switched off on 1 Oct 2021 as part of decommissioning. Access to a revolving line of credit with the flexibility to meet needs as they arise. The credit limit on a home equity line of credit combined with a mortgage can be a maximum of 65 of your homes purchase price or market value.

Credit cards are an example of revolving credit used by consumers. The card carries a regular variable APR of 1224 which is favorable for a secured credit card. Read our article about the advantages and disadvantages of a personal line of credit.

The Definitive Voice of Entertainment News Subscribe for full access to The Hollywood Reporter. Monthly purchase volume and requested credit line. Interest paid may be tax-deductible consult a tax advisor 4.

The The Home Depot Commercial Revolving Charge Card is most effective if youre a high-volume spender at Home Depot. Revolving credit increased at an annual rate of 116 percent while nonrevolving credit increased at an annual rate of 44 percent. Open-ended revolving line of credit.

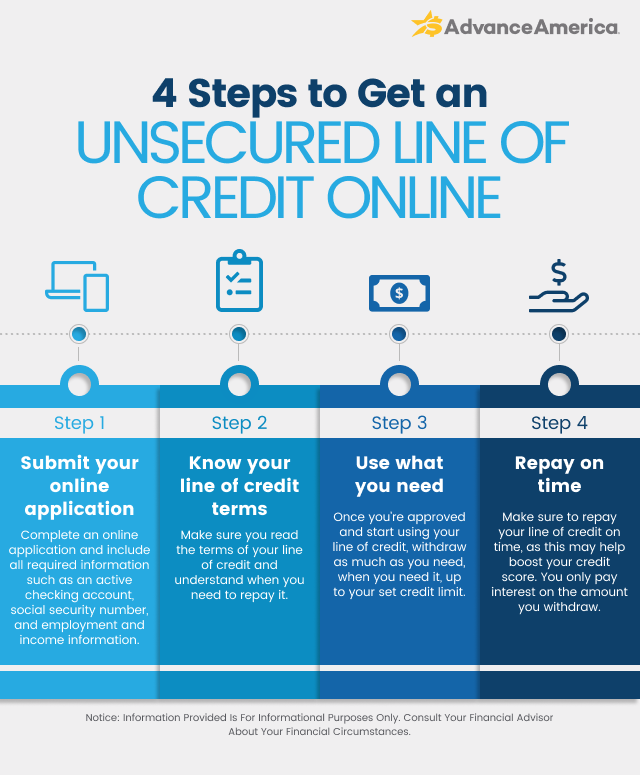

1449 to 2449 variable. An unsecured personal line of credit is a revolving credit account which allows you to draw funds up to a limit. Prime Rate - 051.

In July consumer credit increased at a seasonally adjusted annual rate of 62 percent. While a revolving line of credit is very similar to a credit card its important to remember that they arent the same. A warehouse line of credit is a credit line used by mortgage bankersIt is a short-term revolving credit facility extended by a financial institution to a mortgage loan originator for the funding of mortgage loans.

After getting started a secured card works like any other card you have a revolving line of credit that replenishes as you make payments. Our lenders will not ask for financials bank statements business plans resumes or any of the other burdensome document requests that most conventional lenders demand. When you discuss the terms of your agreement be sure to ask questions and confirm whether or not your line of credit is revolving.

No minimum draw advance required at funding. 247 even when the banks are. Within 24 hours you will receive a welcome email with next steps and access to your project portal.

In 1885 Goldman took his son Henry and his son-in-law Ludwig Dreyfuss into the business and the firm adopted its present name Goldman Sachs Co. To get an insurance quote over the phone call. A pre-approved amount of money issued by a bank to a company that can be accessed by the borrowing company at any time to help meet various financial obligations.

The company pioneered the use of commercial paper for entrepreneurs and joined the New. See frequently asked questions about credit line increases on Capital One credit cards. Dark Brown or Iceberg.

See My Options Sign Up. A business line of credit allows business owners to tap into a credit line on an as-needed basis. If you are perks like itemized purchase statements 60-day payment terms and a one-year return window might be helpful.

L 880 x W 9401670 x H 5101030 mm. Your revolving account balances as reported by the credit bureaus are too high in relation to your. Revolving business lines of credit up to 150000 with repayment terms of 12 or 24 weeks.

If your credit score is keeping you from getting the credit limits you want try to boost your score. A business line of credit is a revolving loan that allows access to a fixed amount of capital which can be used when needed to meet short-term business needs. The cycle starts with the mortgage banker taking a loan application from the property buyer.

The amount of credit available in the home equity line of credit will go up to that credit limit as you pay down the principal on your mortgage. Goldman Sachs was founded in New York City in 1869 by Marcus Goldman. Improve your credit score.

Capital One will replace repair or reimburse you for eligible items in the event of theft or damage within the first 90 days of purchase. Half Leather - 0911mm. Revolving lines of credit are the fastest and easiest way to access additional cash as your business grows.

Learn how to request an increase to your credit limit on your Capital One credit card. A business line of credit is the best financing option when you need extra working capital to cover recurring business expenses or bridge cash flow gaps. Corporate revolving credit facilities are typically used to provide liquidity for a.

In many cases you can raise your credit score in just a few months. We look at income and expenses in relation to your credit score. Then the loan originator secures an investor often a large institutional bank to.

Youll get additional warranty protection on eligible items that are purchased with your business card up to 1 year past the manufacturers warranty. Theres a 49 annual fee. Creative Analytics has the perfect solution revolving credit monthly payment social media plans.

Time to Fund 24 - 48 Hours.

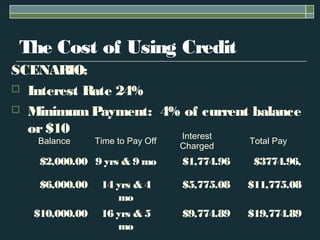

Credit Ppt Download

Revolving Credit Facility Accounting And Finance Credit Facility Financial Life Hacks

Sustained Credit Card Borrowing Grodzicki 2021 Journal Of Consumer Affairs Wiley Online Library

Arian Eghbali

Revolving Line Of Credit Promissory Note Template Download Line Of Credit Promissory Note Tem Notes Template Line Of Credit Critical Thinking Skills

Arian Eghbali

Online Loans For Bad Credit Advance America

Starwood Property Trust Inc 2015 Current Report 8 K

Arian Eghbali

Revolving Line Of Credit Advance America

Pin By Creighton Federal Credit Union On Banking Basics Line Of Credit No Credit Loans The Borrowers

How To Get An Unsecured Line Of Credit Advance America

Arian Eghbali

Cade Ex991 6 Pptx Htm

Revolving Line Of Credit Promissory Note Template Download Line Of Credit Promissory Note Tem Notes Template Line Of Credit Critical Thinking Skills

Credit Ppt Download

New Model Will Change Credit Scores For Better Or Worse Wrgt